XRP under threat of crashing to $2.35 as $100 million moves to Coinbase

![]() Cryptocurrency Sep 3, 2025 Share

Cryptocurrency Sep 3, 2025 Share

XRP’s push to reclaim the $3 resistance could stall as the asset faces renewed selling pressure from whales.

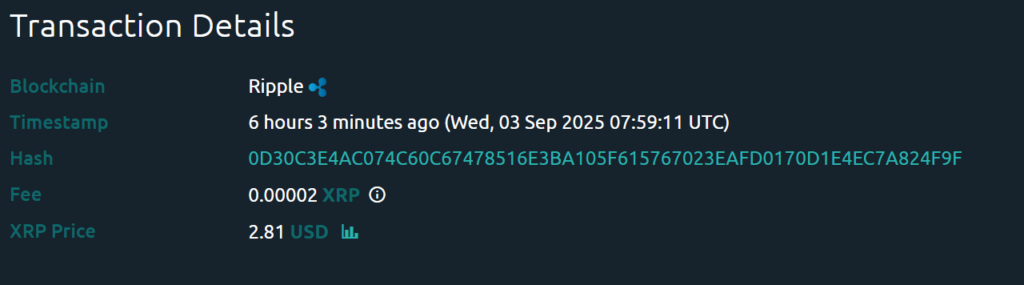

Data indicates a massive transaction of 35,122,576 XRP, worth $99 million, was transferred from an unknown wallet to Coinbase, according to insights retrieved from Whale Alert on September 3.

XRP transfer to Coinbase transaction. Source: Whale Alert

XRP transfer to Coinbase transaction. Source: Whale Alert

Historically, such transfers have sparked fears that whales may be preparing to offload holdings, potentially triggering fresh selling pressure and accelerating a price decline.

Currently, XRP is holding around the $2.80 level, where technical indicators suggest a fragile balance.

To this end, according to cryptocurrency analyst Ali Martinez, the token is now supported by a crucial level at $2.74. Martinez noted that XRP has formed a descending triangle pattern, with repeated rejections along a downward trendline and progressively lower highs signaling persistent bearish sentiment.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

The immediate risk is a breakdown below $2.74. If this level is breached, the next major downside target is $2.35.

XRP price analysis

At the same time, Fibonacci retracement levels reinforce this outlook, showing that a breach of $2.74 could pave the way toward $2.62, $2.56, and ultimately $2.35 as key support zones.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

As of press time, XRP was trading at $2.87, up about 2% in the past 24 hours but down 4.6% on the week. The 50-day Simple Moving Average (SMA) stands at $3.09, placing the current price below this level and pointing to short-term weakness. By contrast, the 200-day SMA at $2.48 suggests a broader upward trend, with XRP still trading above it.

The 14-day Relative Strength Index (RSI) stands at 45.16, indicating neutral territory, neither overbought nor oversold. However, its proximity to the lower end hints at the need for caution.

Featured image via Shutterstock